© MCL & Associates, Inc. 2001 - 2025

MCL & Associates, Inc.

“Eliminating Chaos Through Process”™

A Woman-Owned Company.

03/22/2017:

Suboptimization Revisited: redefining the business lifecycle

In the Winter 2007 issue of the U.S. Army Journal of Installation Management (JIM), I published an article entitled, “Implementing Six Sigma: Exploring Issues in Suboptimization.”

Suboptimization is an engineering concept originally applied to complex mechanical systems. Increasingly, it has been used to understand complex organizational systems and the effects of subsystem dependencies on the Enterprise as a whole.

The principle is pretty straightforward: efforts made to optimize any set of organizational subsystems will often lead to decreased optimization to the overall Enterprise. For those readers not of the baby-boom generation, you are invited to view the still classic, I Love Lucy, “Chocolates” episode that vividly illustrates the problem, and incidentally is still hilarious six-and-a-half decades after its first release: https://www.youtube.com/watch?v=8NPzLBSBzPI.

The I Love Lucy clip reminds us--regardless of the total size of the organization or the intricacy of its systems--that suboptimization occurs, at minimum, at a single choke point that triggers the entire system to degrade over time. In the past, suboptimization has been discussed solely within the context of large systems and organizations. In fact, it can occur in any sized system or organization. We make a mistake in concentrating, solely on the property of “big”.

This refocuses the problem from an exclusively “large” system problem to just an unadorned system problem. Size, now, is not the relevant factor. Rather we must look, instead, at the number and configuration of subprocess levels, subprocess interdependencies, inputs and outputs, decision and action pathways, the number of work cycles at each production step, the time it takes for each step in the entire chain of actions and decisions to produce its final outputs, and of course output quality metrics.

Suboptimization, therefore, applies to all sizes of businesses: small businesses, medium-sized business, large businesses, and multi-market conglomerates. How then, does this new understanding of suboptimization affect our understanding of the business lifecycle?

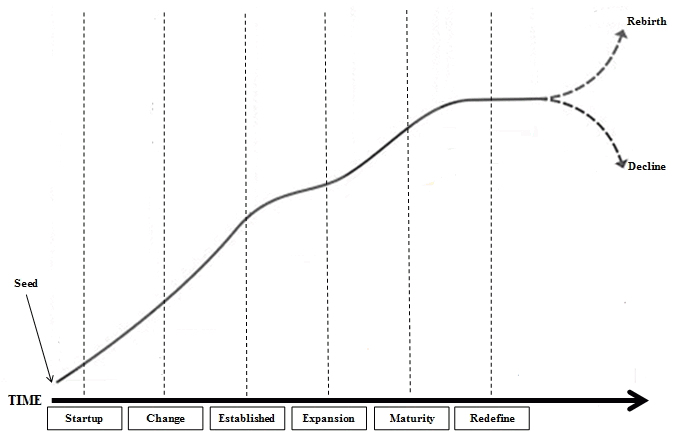

Figure 1: The Traditional Business Cycle

Merriam-Webster (Mar. 2017) defines complexity as, “a part of something that is complicated or hard to understand”. I would amend that definition to include an addendum: “a part of something that is complicated or hard to understand or resolve.”

With such a definition, we can now look at all organizations, across the board.

The Traditional Business Lifecycle

Past renditions have presented the business life cycle as a series of plateaus or stages. In their journey from a relatively immature startup to mature, industry standard enterprise, each business encounters different challenges that require different strategic, tactical, management, marketing, organizational, and financial dilemma solutions.

These dilemmas have been conceptualized by theorists into seven distinct phases:

Seed Stage: There is a business idea. It is developed, and hopefully tested in some way to establish its initial commercial viability. There is a decision that the business idea is worth pursuing, and initial seed capital is created to sustain the company’s startup phase.

Startup Stage: The business is establish as a legal entity. Products and services that the business offers are marketed. Based upon market response and/or customer feedback, products and services are either added or enhanced in some fashion. Sales begin.

Growth Stage: Once past the initial startup stage, sufficiently rapid growth must be achieved so that the cost of doing business is adequately covered by the revenues derived from the activity of doing business. Account Receivables should be greater than Account Payables so that future business needs (repairs, new equipment, maintenance, unanticipated events, etc.) may be adequately financed from the resulting profit surplus.

Established Stage: After a successful initial growth, the business’ core competencies are established. The business is a successful competitor in its market space. Its growth rate has slackened, and the business owner(s) must now consider whether the business can be sustained as currently organized. Whether it is necessary to initiate further growth for a greater market share through expansion of the business. Alternatively, the owner(s) may also consider the option of initiating an exit strategy: to sell the company outright.

Expansion Stage: Expansion requires an influx of new capital to fund this effort. Selling off some of the company’s key assets, or various methods of private loans and/or offering public ownership may be considered as viable funding sources.

Once adequate funding is obtained the business aggressively seeks to achieve a dominant market share in its core business. Simultaneous efforts are initiated to establish new markets and distribution channels that may include: adapting existing capabilities into new products and services that can be sold in new markets, or the acquisition of other companies, or the purchase of selected assets or intellectual properties that establishes a new market foothold.

Maturity Stage: The business establishes itself as a recognized industry leader and standard setter. Expansion into new markets may continue, but the pace is now at a steady, maintained pace. The business is in firm control of its extended market, and in control of it sources of funding.

Redefine Stage: As a result of some change, the business perceives an opportunity or a necessity to redefine itself. New leadership may be initiated to facilitate that redefinition. If the business does not correctly identify that change, the business will decline in profitability, and eventually will either go out-of-business or be sold to other owners.

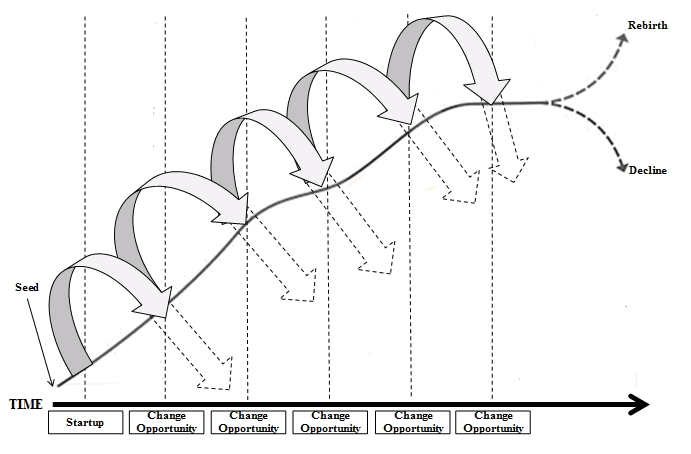

The Change Opportunity Business Cycle

My criticism of the traditional business lifecycle, outlined above, has already been discussed: it cannot be applied equally to all business organizations across the board. Therefore, as a framework for understanding how the activity of business truly works it is virtually worthless.

From my own perspective as a process engineer, it offers no insights into business transformation or any guidance in establishing continuous process improvement within an organization.

Moreover, the traditional business cycle model assumes that businesses must either grow or die. I don’t believe that to be true.

The great preponderance of successful businesses remain small, i.e., less than 100 employees. Some businesses deliberately choose to remain small. Its owners are completely satisfied to maintain a modest, post-startup market share. Perhaps opportunities for growth are limited, or perhaps competition is limited, or perhaps they have shied-away from some of the more negative personal costs of corporate life, or perhaps their egos do not propel them to venture forth to be the next Bill Gates, or Warren Buffett.

Regardless, in the final analysis, businesses need only to remain sufficiently profitable to meet current and future operating expenses to survive. The key, I believe, is accurately recognizing business change events when they occur, and being agile enough as a business to act on that change to either maintain adequate profitability, or perhaps to even increase it.

Aggressive, business growth is only one way to achieve that goal. There are other ways of adapting to change.

Figure 2: Change Opportunity Business Cycle

Rather than a series of plateaus, business is a series of change opportunities that are either recognized or not, that are either acted upon or not, and that are either successfully implemented or not. In effect, all businesses are in either one of three states: a stable As-Is State, an unstable Disintegration State, or a high-activity Redefinition State. Changes that affect the business may occur either internally or externally. In either event, directly or indirectly, they all trigger a loss of internal efficiency and effectiveness, that ultimately lead to a disintegration of the business’ ability to remain sufficiently profitable to meet current and future operating expenses.

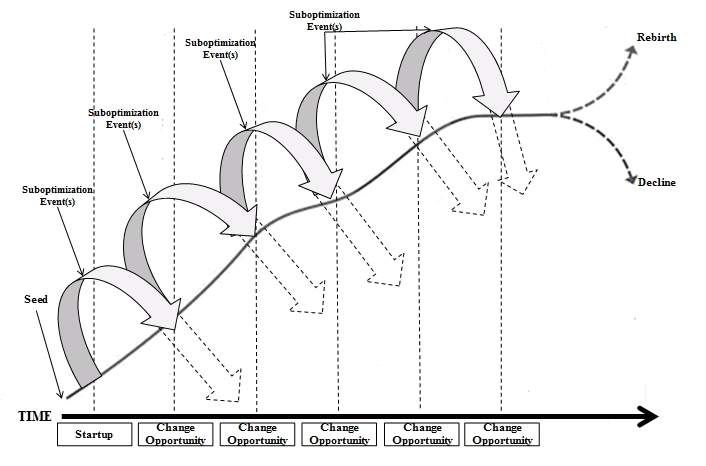

Figure 3: Suboptimization Event(s)

This is where suboptimization re-enters the picture. Whatever that change is, whatever its source, traces of the effects of that change can be detected. If the business owner is sufficiently vigilant, the source of the suboptimization can be identified, and in most cases expeditiously resolved. A small business--particularly a (micro) business whose startup costs are less than $50,000--can do this fairly easily, because the owner is intimately familiar with most--if not all--of the business’ operational processes. Even when there is a shortage of full-time employees and other business resources, small businesses can usually initiate a temporary workaround until a permanent solution can be put in place.

As the business grows, and the number of employees increase, suboptimization events become more difficult to detect, and even when detected and a temporary workaround has been established, a permanent solution is often delayed due to scarce resources or time constraints. The suboptimization event has caused the business process to be modified. It now operates less efficiently and effectively. To one degree or another, the business has entered a state of disintegration.

Suboptimization will increase as the loss of efficiency and effectiveness feeds back into the business system. In turn, this creates more waste and increased operational workarounds that exponentially feed on each other. In turn, further increase business inefficiencies and the inability to conduct business effectively, further increase unnecessary business “noise” in the system.

The business is in a downward spiral. All too often the business owner is completely unaware that they are flying upside-down in a cloud, poised to crash into a swiftly on-coming mountainside.

Businesses, and other organizations, need to pay attention to suboptimization and how it affects their day-to-day operations and their ability to compete in their chosen market space.

BIBLIOGRAPHY

Lefcowitz, M. (2007c). Implementing Six Sigma: Issues in Suboptimization, Journal of Installation Management (Volume 2, Winter 2007, pp. 18 - 28). Retrieved from MCL & Associates: http://www.mcl-associates.com/downloads/ImplementingSixSigma.pdf

Merriam-Webster, Incorporated. (Mar. 2007). merriam-Webster.com. Retrieved from Complexity Defined for English Language Learners: https://www.merriam-webster.com/dictionary/complexity

Thiiokol Chemical Corporation. (1967). Final Report for a Study to Guide Research and Development Toward an Operational Meteorological Sounding Rocket System. Washington, DC: NASA.

© Mark Lefcowitz 2001 - 2025

All Rights Reserved

Business Transition Blog

No part of this document may be reproduced, stored in or introduced into a retrieval system, or transmitted in any form or by any means (electronic, mechanical,

photocopying, recording, or otherwise), or for any purpose, without the express written permission of MCL& Associates, Inc. Copyright 2001 - 2025 MCL & Associates, Inc.

All rights reserved.

The lightning bolt is the logo and a trademark of MCL & Associates, Inc. All rights reserved.

The motto “Eliminating Chaos Through Process” ™ is a trademark of MCL & Associates, Inc. All rights reserved.